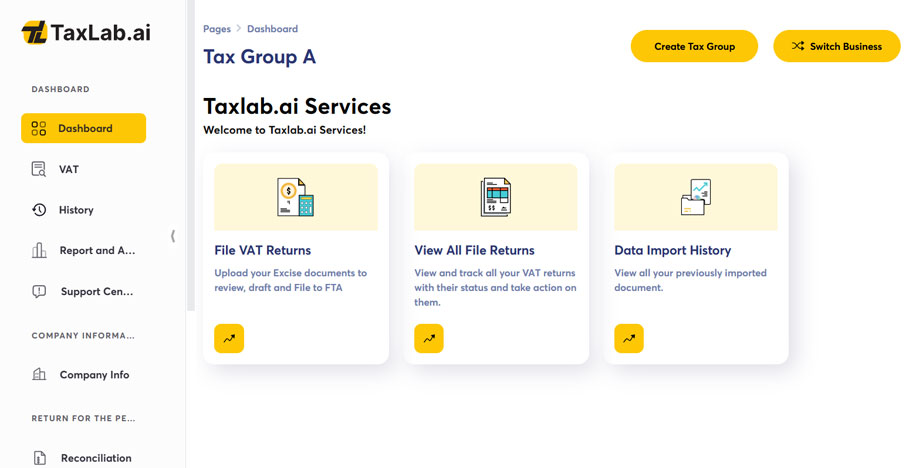

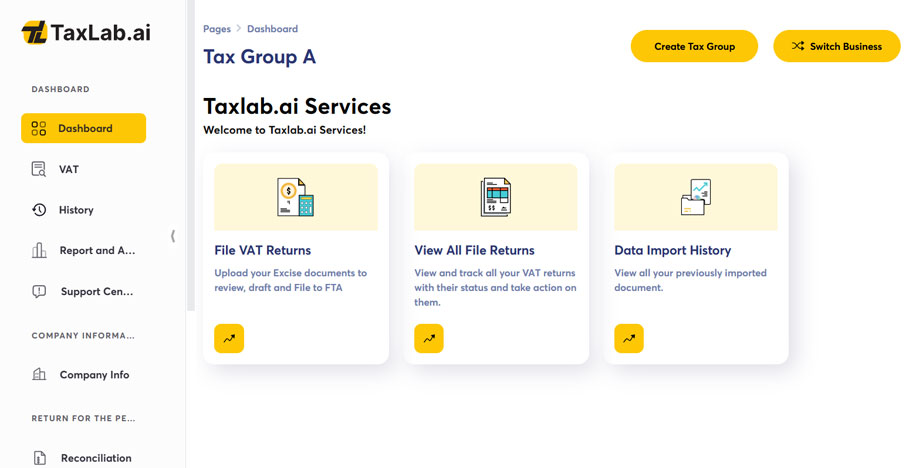

Accurate VAT Returns for

Hassle-Free Tax Filing

In an enviornment where VAT regulations are constantly evolving, our solution is designed to take the complexity out of compliance, allowing business to manage VAT with accuracy and efficiency. From automatic data validation to seamless filing. Our solution enables real-time compliances tracking and simplifies the end-to-end process.